Sweetened Carbonated Beverage Tax Overview

-

Starting on April 1st, 2021 the province of British Columbia will be charging a 7% tax on items considers sweetened carbonated beverages

-

In BC, the provincial tax is 5% GST. The Carbonated Beverage Tax is an additional 7% PST

-

Back-office users can now define items that qualify for this new taxation rule in BC

-

This rule applies to orders processed across all platforms; websites, apps and delivery networks

-

When a customer orders through our platform, the tax rate will be applied to the item in addition to the regular provincial tax

-

For menus that are shared between BC and other provinces, the tax will only apply to BC locations. Provinces are specified in the location set up (Brands & Locations > Edit Location > Contact & Hours)

POS Connected Locations

-

For locations that are POS-connected, the carbonated beverage tax will be programmed as a tax rate for the appropriate items on the POS. Users do not need to setup the tax for applicable items in our back-office if the location is POS-connected AND does not use delivery networks

Delivery Network Integrations

-

For locations that are POS-connected AND use delivery networks, the tax rate must be set up through the back-office for sweetened carbonated beverages on the location’s Delivery networks menu only

POS-disconnected Locations

-

For POS-disconnected locations, back-office users have the ability to add the Carbonated Beverage Tax at the item level as a tax rule

How to set up Carbonated Beverage tax:

-

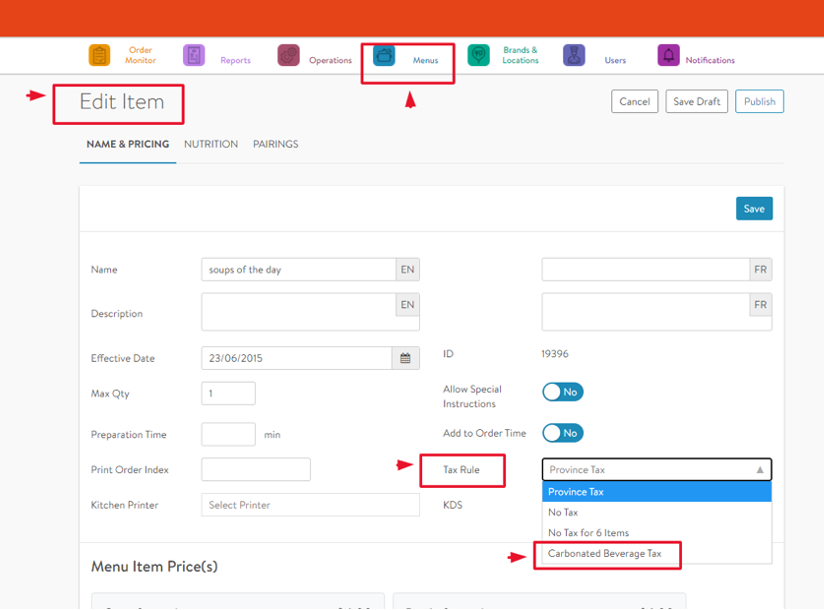

Go to the Menus tab

-

Select your location

-

Add or Edit and Item

-

On the Edit Item page, go to Tax Rule dropdown

-

Select the Carbonated Beverage Tax

-

Publish the item

No additional backend settings or restaurant settings are required.

Comments

0 comments

Article is closed for comments.